Introducing Zero-Gap Renters Insurance

- Renters insurance, always-on compliance monitoring, and a zero-deductible tenant liability waiver

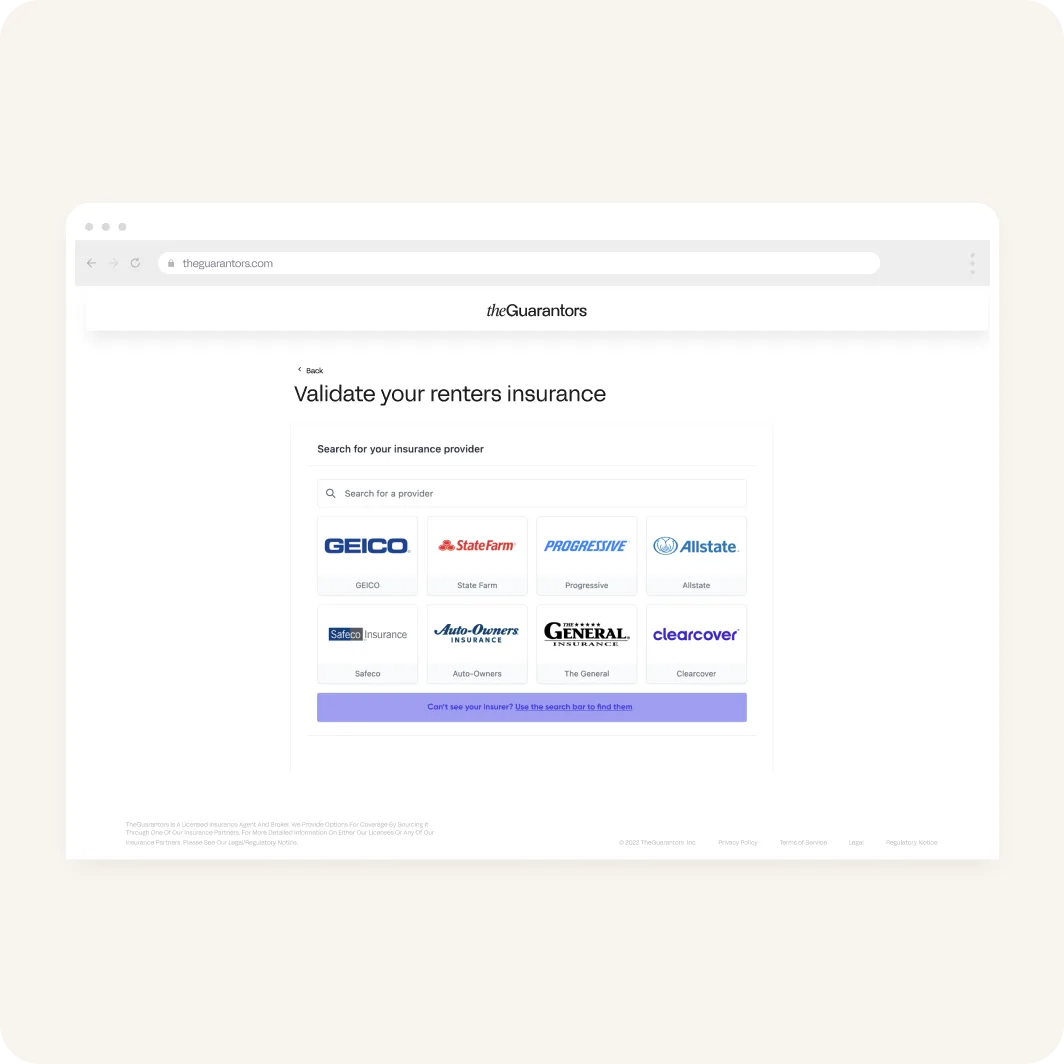

- HO4 Renters insurance with third-party optionality

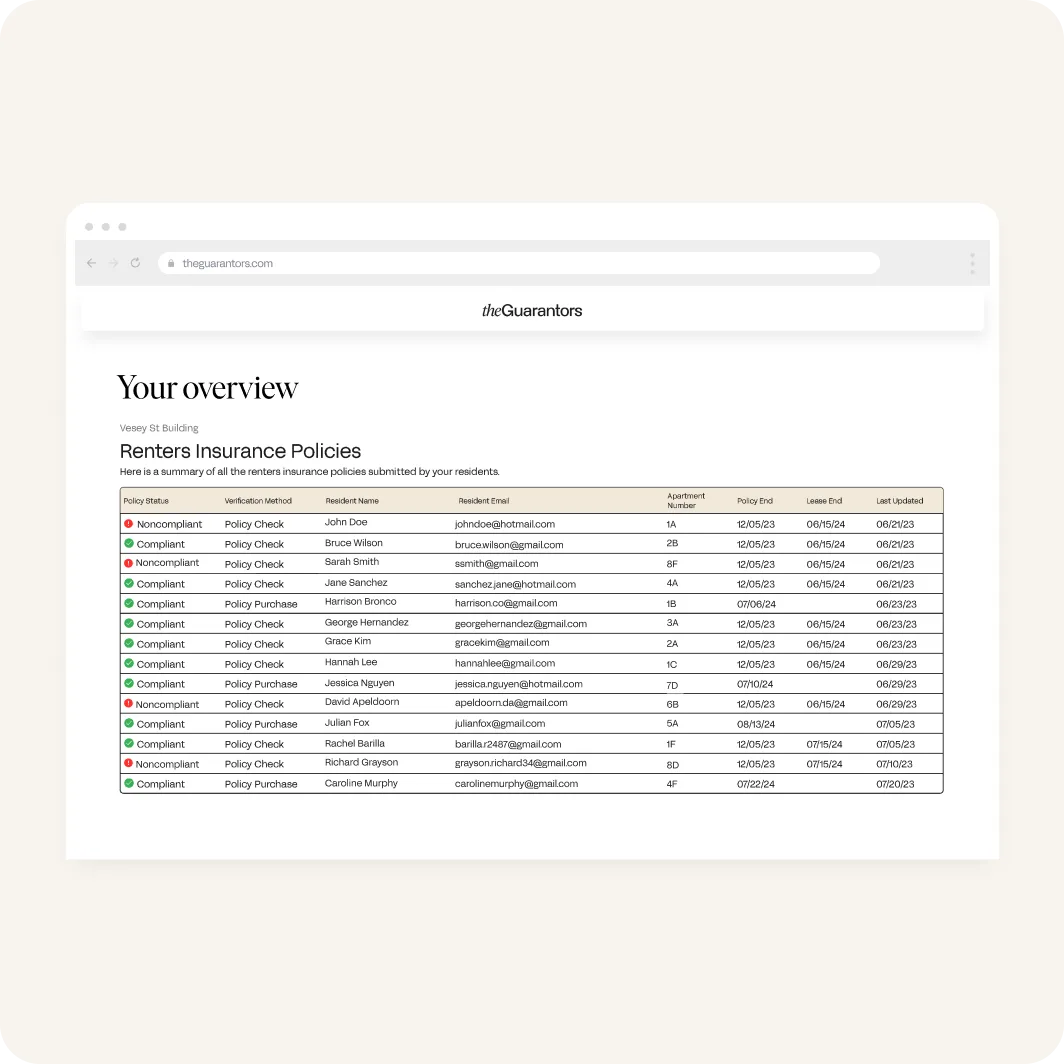

- Proactive notifications that alert teams of policy lapses, saving time and resources

- Mitigate liability and eliminate coverage gaps with backdated landlord-placed insurance when residents' policies lapse

- Ancillary revenue opportunity via a new, per-unit income source